Helsingin toimisto

Käyntiosoite: Kalevankatu 12, 00100 Helsinki

Postiosoite: PL 68, 00131 Helsinki

Puhelin: 09 228 601 (vaihde)

kauppakamari@helsinki.chamber.fi

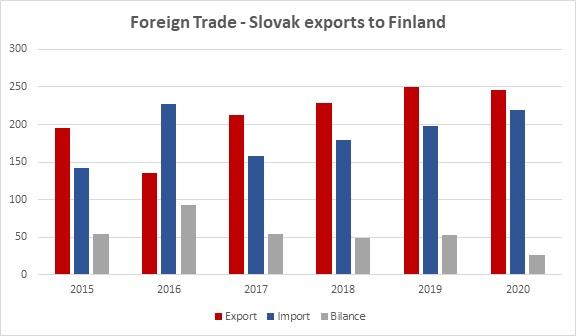

Trade between Slovakia and Finland has shown a continuously increasing volume of trade exchange overall by one quarter in 2015–2020 period. While Finnish exports to Slovakia grew in five years period approximately more than by one third, the Slovak exports to Finland rose less than one quarter in the same period. In general exporting goods from Slovakia to Finland outnumbers the imports from Finland. The exception was recorded in 2016 when the balance turned in favour of Finnish exports to Slovakia.

Based on this assumption the potential for trade development will remain steadily increasing. Recent development due to COVID-19 disease and the measures taken by the governments worldwide will open a possibility to reaccelerate the mutual trade exchange due to disrupted supply-chains existing prior to the crisis, which will have to be replaced by new ones. Simultaneously, increase of consumers’ demand will play an important role in economic recovery, hence, further supporting the potential for trade of goods and services.

(Source: Statistics of the Ministry of Economy of the Slovak Republic)

Among the prevailing trade commodities are listed vehicles other than railway or tramway rolling stock and parts, which Slovakia exports to the Finnish market. This is due to the Slovak economy, which is to a high extend relied on the car production. In fact, Slovakia, with 50 % share of automotive industry on the GDP, is the country with the biggest car production per capita globally. Among the main car producers can be named internationally recognised VOLKSWAGEN, KIA MOTORS, PSA PEUGEOT CITROËN and only manufacturing facility of Jaguar Land Rover outside of the UK in Europe. These circumstances led to development of intense automotive supplier network.

As a second mostly exported commodity were machinery, mechanical appliances, nuclear reactors and boilers. The machinery and equipment industry (MEI) has a strong historical background in the Slovak industry. Currently, it comprises 47 % share of the country’s industrial production and more than 900 companies active in this field closely linked to inter alia automotive industry. Within subsectors of the MEI can be highlighted defence systems, aeroplanes, buses, hydraulic systems, food-processing machines, metal forming machinery, production lines, gearboxes or railway wagons.

Electrical machinery and equipment and parts together with audio-visual appliances represent the third major group of the Slovak exports to Finland. The electronics and electrical components industry (EECI) is one of the top sectors of national income bridging traditional electronics manufacturing (power generators, telephones, radios…) and new trends related to the automotive industry e.g. electromobility, microelectronics, sensors etc. The EECI sector represents more than 9 % of industrial production and is strongly intertwined with MEI and automotive sector. Especially, electromobility is an arena for technology transfer and innovations leading Slovakia towards becoming the CEE electromobility hub.

Slovak exports to Finland clearly reflect the key sectors of the Slovak industrial production. Therefore, the possible forecasts regarding the mutual foreign trade development from the Slovak perspective could be summarised as steadily growing mutual trade exchange in traditional sectors as it was in previous years of 2015–2020 period. A new path for foreign trade development could possibly be the new technologies and services in terms of innovations, space technology and cleantech arising on the background of internationally changing paradigms towards sustainability and green economy.

(Source: Slovak Investment and Trade Development Agency – SARIO; TRADE MAP)

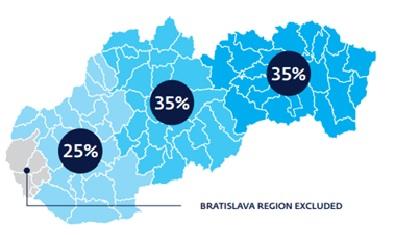

The main intention of the investments incentives provided by the government is to support allocation of the incoming investments into regions with increased levels of unemployment and so to minimize the regional disparities within the country. On the other end, equally important is to support establishment of investments with higher added value.

In general, Bratislava capital region is not included due to high economic performance in comparison to other regions. However, the incentives plan mentions a few categories eligible projects for incentives – industry, technology centres, combined projects of industrial production and technology centres and shared services centres. Among eligible costs can be found costs related to land acquisition, building acquisition and construction, new technology equipment and machinery acquisition, intangible long-term assets (licences, patents etc.) or wage costs for new employees over period of 2 years. Regarding the forms of incentives, the incentives can take form of tax relief, cash grants, contributions for the newly established jobs and rent or sale of real estate. Regarding the concrete criteria of applying for incentives see the updated and detailed scheme. It is recommended to contact investments specialists of the Slovak Investment and Trade Development Agency (SARIO) for free of charge individual consultation to best meet the needs of any individual project proposals.

The most recent Finnish investment project successfully established in Slovakia with assistance of the SARIO agency was in 2019; an industrial site of multi-industrial and high-technology corporation MSK Group (MSK MATEC s.r.o.) in Prešov region located in eastern Slovakia. The volume of investment was 7,9 million EUR and led to creation of a hundred job opportunities. The site produces cabins for construction machineries with R&D related activities.

(Source: Slovak Investment and Trade Development Agency – SARIO)

Slovak start-up environment started to develop in 2010–2011 primarily in the private sector and two years later public administration in accordance with the EU Commission programmes introduced national measures to support emerging businesses and start-ups in correlation with the EU’s operational programs e.g. operational programme Research & Innovations. Currently, it is estimated that within Slovakia more than 600 start-ups can be found. Slovak start-ups were according to surveys of the Slovak Business Agency mostly in beta phase and were represented by individuals younger than 35-years-old with university education. These start-ups usually have to face major hindrances such as insufficient financing and real-life business experiences. Nevertheless, Slovakia has become known due to some of the start-ups nowadays recognised worldwide.

The most relevant contact point for start-up scene in Slovakia is the Slovak Business Agency. Since its establishment it endeavoured to be at disposal for those who intended to start or further enhance their businesses. Especially, the activity labelled as “Startup Sharks” aimed to support innovative and competitive ideas and their embeddedness in markets and mitigate the obstacles in process of developing start-ups. In compliance with the schemes of the Ministry of Economy of the Slovak Republic to start-ups provides Slovak Business Agency information and practical consolations related to establishment and developing of a start-up, training and workshops concerning relevant topics, mentoring and expert guidance and covers the costs related to participation in international events.

(Source: Slovak Business Agency)

The best examples of successful start-ups could be the company sli.do s.r.o. (LLC) and its innovative approach towards interactions during various events. Q&A and polling platform developed by sli.do allows audiences to directly approach the ongoing panel discussions and so bridging the gap between speakers and their audiences. Services of sli.do were already used during more than a million events. Additionally, biometry system developed by company Innovatrics allows to modernise election system i.a. of The Republic of Guinea to a more just and transparent. Last but not least, in relation to the recent paradigm shift towards sustainability and circular economy the company SENSONEO developed a specific system of sensors for waste management and collection to optimise the garbage collection and so to save costs and effectiveness of various municipalities and private businesses in more than 40 countries. SENSONEO is a successful Slovak story recognised by the European Innovation Council.

In 2018, Government of the Slovak Republic launched the Innovation diplomacy project, aimed at enhancing cooperation with innovation environment abroad and support of partnerships between private and public sector. It came as no surprise that one of four countries Slovakia decided to enhance cooperation with was Finland. The project helped to promote and connect startups between Slovakia and Finland.

The pandemic hit Slovakia hard especially during its second wave by December 2020 and the first quarter of 2021. Currently, the situation is under control with almost 6 000 PCR tests done per day and +246 positive cases identified per day. Hence reaching one of the lowest occurrence of the COVID-19 disease in the first quarter of 2021. Regarding the measures taken, the government established the so called “COVID-19 automat”, which evaluates valid rules of lockdown and prevention against spreading of the disease measures by every district individually. In general, easing of preventive measures led to opening of less antigen testing obligation (used to be once per week) and opening of shops and terraces of F&B facilities. The state of emergency ended on May 15, 2021. Travelling abroad for leisure purposes is not allowed and business travels are allowed with the exception issued by the Ministry of Economy of the Slovak Republic granting entrance into the country without the condition of two-week quarantine. PCR negative test is also required (max. 72 days prior to visit). Easing of the measures is advancing and the government is reconsidering these on weekly bases.

(Source: Ministry of Investments, Regional Development and Informatization of the Slovak Republic,

Ministry of Economy of the Slovak Republic)

In order to support business affected by the COVID-19 crisis, the Ministry of Economy of the Slovak Republic developed a scheme of measures divided into three groups of applicants – company, self-employed person and natural person. These measures are rather similar to those applied among other countries in the CEE region and are centred on compensation of income loss with compensation calculated on the volume of generated loss, compensating the costs related to employing staff, pandemic nursing and sickness benefits, delay of the tax and rent payments, issuing of bank assurances etc.

Regarding the surveys of the SMEs opinion polls focused on experience with state support during COVID-19 pandemics the majority of SMEs evaluates the state support as insufficient (56,1 %). Those opinions are mostly perceived by those sectors that suffered remarkably during the pandemics – accommodation and tourism, culture; and mostly in Bratislava and Košice region. For positive evaluation opted approximately 27 % of respondents, naturally representatives of those sectors which suffered less during the crisis. Negative opinions identified as the major problems i.a. complexity and perplexity of the support scheme, insufficient information and criteria for applicants and possibility of sanctions in case of entering improper data in the application form.

(Source: Ministry of Economy of the SR, Slovak Business Agency)

The way ahead is outlined in the new recovery strategy intertwined with the EU recovery funds. The government recently submitted the national plan applying for the funds aiming towards acceleration of necessary reforms and public investment projects. The expected volume of funds is approximately 6 billion EUR divided into a few fundamental areas:

This reforms and investment are meant to be in unity with sustainable public finances and aim to support tax system reform, retirement system reform, national budget responsibility and more effective public investments management.

(Source: The News Agency of the Slovak Republic, Ministry of Finance of the Slovak Republic)